What Does a Healthy Innovation Portfolio Look Like?

The concept of an innovation portfolio is still new to some organizations; however, it’s been a topic of conversation among innovation professionals for years.

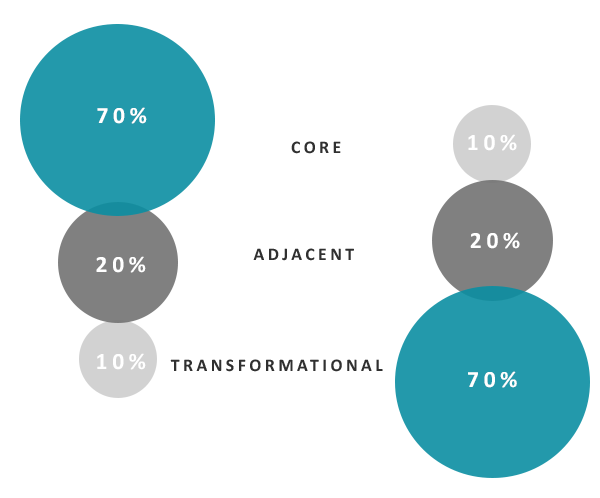

In 2014 Harvard Business Review (HBR) published the article, Managing Your Innovation Portfolio. They found on average high-performing organizations focus 70% of their innovation resources on core or incremental offerings, 20% on adjacent offerings, and 10% on transformational initiatives. Even though the average was a 70:20:10 spread, they still reference other successful models depending on your industry and your level of ambition and allocations.

The biggest take-away from the HBR report and subsequent reports is that for an innovation program to be successful, the focus should be a mix of incremental (core), adjacent and transformational initiatives. This mix will enable a program to deliver results both in the near term and long term.

In addition to finding the right balance, organizations need to have the right resources to deliver. These include:

- Talent

- Integration

- Funding

- Pipeline Management

- Metrics

In 2017, Inc. published the article, If You Want to Innovate –and Disrupt–Rethink the 70:20:10 Rule. In this article, Jeffrey Phillips looks at the factors that can impact this Rule, and while it may work for some, it will not work for industries looking to create breakthrough or disruptive innovation every 6-8 months.

Before we dive deeper into different rules and how your industry and innovation initiatives will impact your strategy, let’s review the types of innovation initiatives and the short/long-term return potential.

- Incremental/Core – largest investment, smallest potential long-term return

- Breakthrough/Adjacent – medium investment and potential long-term return

- Disruptive/Transformational – smallest investment, largest potential long-term return

For the short and long-term potential of an innovation portfolio, we’ll use the Three Horizons of Growth, created by McKinsey & Company. Today, some will argue that this model no longer applies, in that case, we will use it as a guide for prioritization.

- Horizon1: Core/Incremental 0-1 years (short-term)

- Horizon 2: Emerging/Adjacent 1-3 years (mid-term)

- Horizon 3: Disruptive/Transformational 3+ years (long-term)

70:20:10 Innovation Portfolio Model

Google CEO Eric Schmidt pioneered this model. With additional research, Google confirmed that the companies that followed this model typically outperform their peers by a margin of 10-20% (P/E ratio). They also concluded that the long-term returns for each type of investment are actually the inverse of the resources invested.

When we place innovation activities into three “horizons” (incremental, breakthrough, and disruptive), the general Rule of thumb is that most companies should be doing 70% incremental, 20% breakthrough, and 10% disruptive innovation. Note that this Rule of thumb assumes that innovation is ongoing and that other activities are underway, sometimes simultaneously.

85:10:5 Innovation Portfolio Model

For risk-averse organizations, the 85:10:5 model is more conservative. This model tends to work well for consumer goods companies. The most significant focus is on the core/incremental initiatives while allocating resources for both adjacent and transformational innovations. When considering this model, make sure it aligns with your long-term innovation goals.

55:30:15 Innovation Portfolio Model

For organizations that are risk-tolerant, they may want a more aggressive 55:30:15 innovation portfolio model. This model focuses on the core/incremental initiatives but allocates more resources for adjacent innovations and focuses on transformational innovations. When considering this model, make sure it aligns with your long-term innovation goals.

40:40:20 Innovation Portfolio Model

Disruptive organizations looking to be more aggressive than the risk-tolerant portfolio may want to consider a 40:40:20 innovation model. Technology companies who are striving for transformational innovations focus more of their resources on being disruptive. There is more risk with this model, but the industry has inherent risk. When considering this model, make sure it aligns with your long-term innovation goals.

Take, for example, the cell phone industry. Imagine trying to innovate with a 70% incremental goal when every other handset manufacturer tries to create breakthroughs or disruptive innovations every 6-8 months. In slow and steady industries, a 70:20:10 investment model may make sense. In industries with a faster pace or more dynamic change, we may find a more aggressive investment strategy that makes more sense or some other investment strategy.

Conclusion

While 70:20:10 is a well-balanced innovation portfolio recommendation, organizations with greater risk-aversion or risk-tolerance should consider adjusting these proportions according to their innovation gaps and growth needs. The REAL answer is that there is no standard.