Have you ever been in that electric environment where everyone around you possesses an intricate and expansive wealth of knowledge?

If you answered yes, you know exactly the type of occurrence we are referring to.

It’s the kind of conversation that captures your attention (and hours of your life), and when it’s over, you feel like your IQ has increased by at least 5 points.

That is precisely the experience we had at the Innovation Executives Dinner held in San Francisco after our CEO Brant Cooper’s appearance at Mind The Product. We had the pleasure of co-hosting this amazing event with six-time entrepreneur David Binetti and special guest Kent Beck (one of the original signatories on the Agile Manifesto), and the discussions held by each of these three innovation powerhouses was a sight to see.

Kent Beck: The Three Phases of Growth

Our first speaker Kent Beck serendipitously came across our event on social media and we were ecstatic when he reached out and communicated that he wanted to be a part of it.

His talk really set the stage for the rest of the evening, so we are more than delighted it worked out.

Currently, Kent is living the “funemployed” life playing poker 5 nights a week and pursuing other resurfacing hobbies after many years spent building a successful career as a software engineer and author.

(Take a look at his Twitter art series “Illuminated Tweets: Software Cleanup”)

2/8 in the series “Illuminated Tweets: Software Cleanup” pic.twitter.com/LJB3vs6N8C

— Kent Beck (@KentBeck) July 13, 2018

Even so, he is still one of the most in-tune leaders when it comes to startups and innovation.

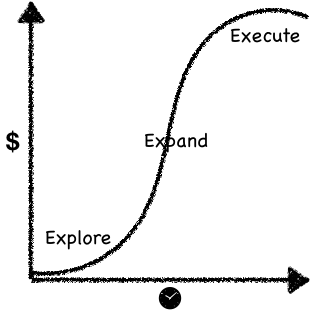

His brief yet interesting talk focused on the three phases of growth, articulated by “3 E’s” on top of a “S” curve. All successful startups (or innovation efforts) growth through Explore, Expand and Execute phases. (Brant was quick to point out the 4th ‘E’ is End of life.) This is important because the company looks and acts differently in each phase.

The transition points, especially, are particularly challenging.

A business typically recognizes they are maturing from the exploratory phase into expansion, since product is flying off the shelf (literally in physical products, figuratively in the digital world.) This is commonly referred to as Product-Market fit. The entire business must transition to a growth driven organization. Easier said than done.

Eventually, the business matures to reach the “execution” phase.

The business understands the market and has developed a proven, scalable blueprint to winning the market. There is very little exploration remaining. It must again transform nearly all of its systems to focus on efficient and highly productive operation against well-known challenges.

This advice is particularly challenging for those leaders who attempt to drive their companies from inception through maturity.

Kent, who had a front-row seat during Facebook’s expansion phase, posited that their current woes with respect to privacy and user manipulation are related to not changing employee incentives when they matured from expand to execute.

Fast-growing startups often link compensation to achieving growth in a particular metric, such as advertising spend, or user engagement. The teams assigned to that metric are not regulated in any sense on HOW they achieve that metric.

Small startups can get away with it. When you achieve execution mode, however, the company is likely to earn serious repercussions when the behavior is exposed. Brant suggested that the behavior to achieve metrics must be subject to corporate values.

The spirited conversation was both provocative, and the perfect lead into our next guest and co-host David Binetti’s presentation on getting buy-in from the finance department for innovation initiatives.

David Binetti: Getting Buy-In for Innovation from Finance

As a six-time entrepreneur, leading management consultant, and the creator of the Innovation Options Framework, David has seen his fair share of innovation projects meet their untimely demise because the innovation team couldn’t secure the resources needed from the finance department necessary to execute.

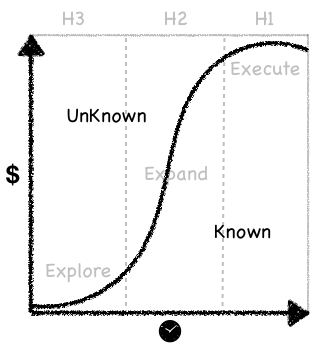

David started by pointing out that Kent’s phases mapped directly to the three horizons of growth, a framework originally pioneered by at Steve Coley at McKinsey & Company, Inc back in 2000.

This concept helps organizations “manage for current performance while maximizing future opportunities for growth.”

The concept is simple: large businesses must allocate resources to create growth across 3 time horizons:

-

– H1, representing the core business;

-

– H2, the emerging opportunities;

-

– and H3, which are new growth opportunities down the road.

David pointed out that startups or innovation initiatives in the Explore phase are essentially H3 projects. Those in Expand have found some traction and are, therefore, “emerging” H2 projects.

When you’re executing, you are now a fully fledged, execution only H1 enterprise.

The trick in the enterprise, of course, is that when you’re an H1 execute business, your next phase is “End of life”, so you better be investing in Explore again. This is hard and businesses do it poorly. This was the primary topic of David’s talk.

All too many times, David said, a “big idea” emerges, and you’ll gather your people, draft the business plan, bring a powerpoint to the finance team or leadership, only to hear them say, “Sounds great. What’s the ROI? And When will we see it?”

Sound familiar?

Thus enters one of the biggest problems in corporate innovation: when you innovate, there’s no history to draw from. You can’t create a Return on Investment (ROI) estimate without a stream of projected cash flows far into the future.

In early search mode, so little is known that estimating months out is nearly impossible, much less years. And while it would be ideal to have everyone’s favorite hockey stick growth curve appear upon implementation of your big idea, there are several other, less desirable and frankly, more likely, outcomes for these long-term projects.

The fact is, there’s no possible way to know what you’re going to get until it’s too late. You’ve already sunk the costs.

Without a solid, predictable ROI above the corporate hurdle rate, there is no funding. A terrible incentive for creative business plan writing.

David then went on to explain that there is a solution to this problem: You must provide your finance team with a model that treats innovation opportunities as options investing. You are buying future growth at today’s price.

For innovation leaders, it is a matter of categorizing projects in a manner which better suits their actual financial performance. Innovation projects should be valued like insurance policies.

David asked the attendees, “What was the ROI on your life insurance policy last year?”

Wry smiles abound.

When there’s massive uncertainty, option pricing hedges your bets such that you’re more likely to succeed and achieve the non-linear growth you seek, than taking a leap of faith based on a fictitious 10-year cash flow model.

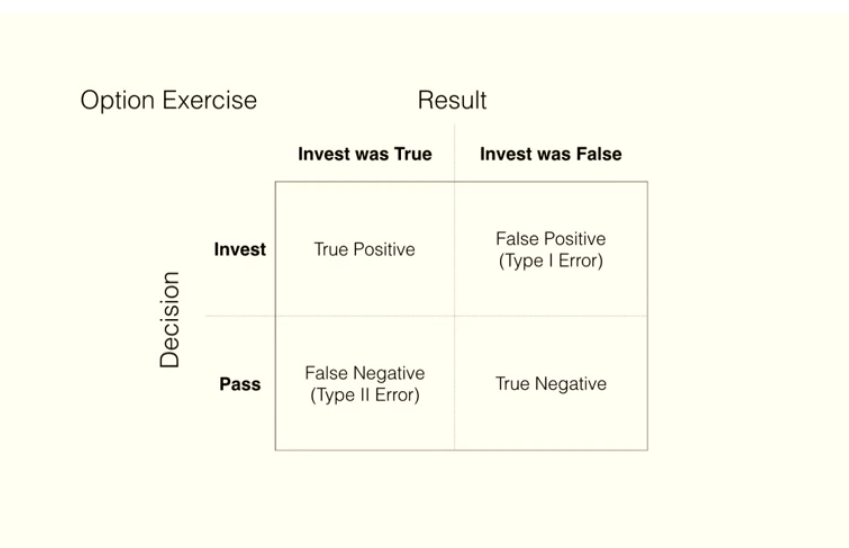

David broke down investment decision for innovations to a traditional four-square decision matrix that looked something like this:

Often times, internal analysis is only done on the affirmative half of the matrix.

David’s challenge to leaders is to track all four of the quadrants to evaluate internal decision making.

Brant Cooper: Searching vs Executing

Brant closed the speaking segment of the evening by adding a third dimension to the chart.

His point: uncertainty doesn’t exist ONLY in the far-off H3 time horizon. It’s no wonder executives are looking for immediate ROI when what keeps them up at night is the uncertainty in hitting their numbers this quarter.

Brant’s thesis is this: In order to get leadership to buy into option planning, you must act entrepreneurial (Empathy, Experiments, Evidence), whenever there’s uncertainty.

You must practice Empathy to learn where the near term uncertainty lives. You “cut a deal” with leadership: if we reduce uncertainty in the near term, you’ll fund longer-term projects that help us reduce uncertainty around future growth needs.

Brant calls this the Rosetta Stone for Corporate Innovators. You must learn to speak their language and help resolve their near-term uncertainty.

Food for Thought

The room was contemplative following these initial discussions, so much so that some attendees hadn’t even had a chance to look at the dinner menu yet. The concepts divulged in the presentations continued to resurface within smaller conversations as a running theme tying the entire evening together.

At the end of the night, it became clear to all in attendance that while innovation is making progress as a necessity inside larger business entities, there is still work to be done when it comes to framing.

Bottom line?

-

– A business must not only know precisely when they are maturing into the different phases, the entire business must transition into systems and processes, always aligned to corporate values.

-

– Without an ROI above the corporate hurdle rate, there is no funding, so giving your finance team a financial instrument model to hedge risk and turning “learnings” into dollars (a currency that finance understands) helps everyone in the organization align on investments in future growth.

-

– Companies must practice “entrepreneurial spirit” wherever this is uncertainty, even in achieving near-term priorities.

Have any insights on these topics that you’d like to share?

Be sure to follow us on Twitter and tweet us your comments.

Additional Resources:

Looking for more on this topic? Here are some additional resources worth checking out.

-

– Brant and David discuss the ROI of Innovation in this video and accompanying blog post.

-

– David discusses Innovation Accounting at the Lean Startup Conference in this video.

-

– Brant and Simeon’s Rosetta Stone discussion