________________________________________________________________________________

Click & Connect with Matthew: LinkedIn . @mgriffin_uk . +44 (0) 7957 456194

About the Author: Recognised in 2013 and 2014 by the public as one of Europe’s leading Emerging Technology and Disruption Strategy advisers Matthew Griffin is an international speaker who works with global Accelerators, Analysts, Entrepreneurs, Investors, Governments and Fortune and FTSE multi nationals to help them reinvent themselves and adapt to new market conditions.

________________________________________________________________________________

No other metric more important to an organisation than its profitability. Profitable companies can invest and acquire while unprofitable ones slowly sink into the abyss of Chapter 11 but while profitability is one of your organisations biggest motivators the unchecked pursuit of it can eventually destroy shareholder value and create your next, fiercest competitor as Apple (AAPL) and their shareholders found out to their peril when the stock plummeted from it’s high of $700 to a value of $566, wiping out over $150 Billion of shareholder value.

Company Executives are increasingly compelled to report profit in percentage terms so naturally they promote and reward the behaviours that increase margins. As such the pursuit of higher profit margins, rather than the pursuit of voluminous profits becomes the dominant behaviour and today we’re seeing several sectors of the western economy, such as manufacturing, assembly and engineering decline as many of the world’s largest first world organisations progressively outsource cost intensive segments of their businesses to the Tiger economies and risk becoming nothing more than high margin, damaged marketing agencies who have outsourced everything but their brand.

The two primary methodologies organisations, analysts and Wall Street use to measure profitability are the Internal Rate of Return (IRR) and Rate of Return on Net Assets (RONA) because by describing profitability as ratios it allows us to neutralise differences and compare the profitability between different industries. IRR inadvertently motivates organisations to focus on smaller, faster wins because if they use their money to fund programs that don’t pay off for years then the ratio is at best modest, meanwhile RONA motivates organisations to reduce the number of assets they hold on their books.

Consequently organisations have a strong incentive to shed their cost intensive or lower margin operations so they can concentrate on business units that have higher margin returns. There are, of course, a number of ways that organisations can divest these operations in a way that boosts their overall average margins. Some organisations like IBM choose to dispose of their commodity business units while others like Apple, Amazon, Cisco, Sony, Nokia, Dell, HP and many more prefer to outsource specific operations which allow them to tactically withdraw or transfer their own resources and sell the related assets. At first glance outsourcing looks like a Win Win for both the organisation and their shareholders and it’s hard to fault the approach. Disposing of the related assets improves the organisations cash reserves while the reduction in overheads lifts the organisations average margins and Earnings Per Share. However, what very few organisations see – at least until it’s too late – are the downstream effects and how outsourcing can create their fiercest competitor and destroy long term shareholder value.

Once an organisation has made the strategic decision to outsource their operations – irrespective of the industry it’s incredibly difficult and costly bring them back in house. The assets have been sold, the supply chains and skilled teams have been dissolved and the intellectual capital has long since been lost and once an organisation has embraced the outsourcing habit it’s one they’ll find hard to break. Consequently what started off as a simple way to eliminate costs and increase IRR and RONA suddenly becomes an easy to repeat addiction and as an organisation outsources more and more of its operation with every turn of the handle they may be unwittingly equipping their next, most formidable competitor. Whether it’s HP’s x86 server ODM (Original Device Manufacturer) Quanta who now sits in second place in the worldwide IDC Server Market Share rankings ahead of Dell or IBM’s ODM Lenovo who are now pounding their Systems and Technology Group in markets around the world it’s inevitable that at some point outsourcers will examine how they can leverage their new insights, assets and skills to become a Brand and competitor that reaps higher than average industry margins.

Beware of the lure of outsourcing

Today there are a myriad of organisations who have outsourced segments of their business and inadvertently helped enhance their future competitors competitive capabilities but despite this it’s arguable that none of the competitors those organisations helped create come close to the two super powers that Apple has unwittingly created – I am, of course, talking about Samsung, and their sister company Samsung Electronics, and Foxconn who since their association with Apple began have both increased their revenues by 11,461% and 6,002% respectively.

Many bystanders are more likely to view these two giants emergence onto the global stage as business evolution rather revolution and while Samsung declared their competitive intentions in 2008 Foxconn has only recently reached the starting line of its long journey. In each case I will show you how both companies have combined renewed board ambition and the investments they made in equipment, processes and people to service their contractual agreements with Apple with the strengths of their core business models to fuel their meteoric rise to fame and fortune.

To understand Samsung’s rise to dominance we have to go back to the turn of the new millennium when Apple released their first generation iPod in 2001, quickly followed by the iTunes store in 2002. Always publicised as the only alternative computing platform to the then dominant Wintel alliances of Microsoft, Dell, HP and IBM Apple always had an iconic – dare we say cult like following even if it didn’t have the revenues to match. Apple were the bullish underdog that kept nipping at the heels of the Wintel alliance but one that rarely came up in any of their competitive planning sessions. Over the next ten years Apple sold over 320 million iPods and as they introduced more products such as the iPhone in 2007 and the iPad in 2009 which, at the time of publishing this article, have both respectively sold 421 million and 170 million units their annual revenues grew from $5 Billion to an eye watering $171 Billion. It’s this growth and the insights into Apple’s operations that helped Samsung and Foxconn craft their own spectacular rises to power.

Almost from the start of its journey Steve Jobs and the Executive Board shaped Apple into an innovative Design company and this is an important distinction to make. Design companies focus on creating beautifully designed, frictionless products and are commonly less interested in administering the cost intensive, low margin manufacturing and assembly operations that inevitably rely on facilities that have to be built, managed and supplied in order to create the final product. Consequently Apple was determined to outsource both of these areas of operation from the outset. The lion’s share of manufacturing many of Apples most bespoke and critical components, including the screens, Flash and DRAM memory and the fabrication of Apple’s bespoke logic processors for all of Apples flagship lines was outsourced to Samsung Electronics (SSNLF) and the responsibility for assembling the iPod, iPhone and iPad was outsourced to Apple’s long standing partner Foxconn.

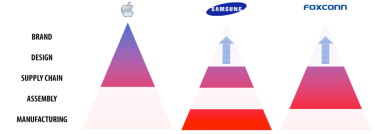

Fig 1. Samsung and Foxconn push up the Value Chain

In the early days, when volumes of Apple branded products were lower than they are today Samsung and Foxconn were happy with their position in life but as time progressed and as they saw Apple’s money pile growing into a $150 Billion mountain their Board’s ambitions grew. When you feed off of the scraps of the Kings table for long enough – and when we say scraps we of course mean when you collectively only make $52.68, at an average margin of 12.02% for Samsung and an average margin of 1.70% for Foxconn, from the sale of each iPhone versus Apple’s staggering $368 – sometimes your mind turns to thoughts of rebellion and what you’d need to do to be the next heir apparent …

Why be the iconic customer’s manufacturer when you can be the Icon? Why be the assembler when you can be the Venture Capitalist behind the next big technology wave? In each case both Samsung and Foxconn had the same ambitions – to push themselves up the Value Chain and become the Brand where they could realise higher margin returns and that’s precisely what they did. Over the course of their ten year partnership with Apple both organisations had developed highly efficient global supply chains capable of supporting their new aspirations so it was simply a matter of filling the capability gaps in their value chain – namely ‘Design’ and ‘Brand’ development. Their manufacturing and assembly plants, processes and employee skill sets had all been honed over time to make and assemble Apples products so it was inevitable that the products that they chose to produce and invest in themselves, namely smart phones and tablets, would eventually put them in direct competition with their largest customer.

Samsung was the first company out of the blocks in 2009 and their new strategy put them firmly on a collision course with Apple. They spent billions, struck up a relationship with Google Android and worked hard to boost their Design and Innovation practises by investing heavily in new multi-disciplinary satellite centres around the world. Ultimately these created the Galaxy S3 and S4, the world’s best-selling smart phones and the world’s number two tablet, the Galaxy Note.

Later, in 2013, Foxconn chose a less confrontational approach, preferring instead to create a Venture Capital backed Hardware Accelerator program that invests in and supports designers and innovators of interest, helping them refine their products ready for the mass market and, with Apple expected to release the iWatch it’s probably not by coincidence that the first product that they chose to invest in was a Smart Watch…

Given the rise of these two new co-petitors and their increasingly dramatic impact on Apple the organisation had to make a number of tough choices, all of which were made even more complicated by the depth of relationship, integration and business insights between the triumvirate. Their choices included fighting Samsung for market share with all of the downstream implications that that would undoubtedly have on their revenues, margins and share price, alternatively they could work diligently to innovate new products for the mass market or they could choose to do both. Irrespective of the choice though everyone knew that they were on a collision course with two of their largest strategic partners.

In late 2013 with their share price stalled for over a year at $550 and activist Carl Ichan pressing for the introduction of a $150 Billion share buyback program Tim Cook, Apples CEO, implemented a raft of new initiatives designed to build new growth and reduce Apples dependency on their co-petitors. The first initiative to be announced was the introduction of the iPhone 5C, a scaled back, low cost iPhone assembled by Foxconn’s smaller competitor Pegatron and squarely positioned to compete with Samsung’s cheaper alternatives. Next came the decision to bring manufacturing of some of Apple’s smaller flagship lines such as the iBook back to the US and then finally the announcement that in 2014 Apple was switching all of its $10 Billion annual memory and processor orders to Samsung’s arch competitor TSMC. As for the future as Apple strives to create and dominate untapped mass markets it now looks certain that they will be introducing two highly hyped, revolutionary new products in the iTV and the iWatch.

Conclusion

Outsourcing has clear cost and scale advantages and managed correctly it will let you refocus your organisations resources on areas that drive growth – however, as we can see from our example, outsourcing areas of your business that underpin your organisations key revenue generators – such as software development, manufacturing and product assembly can have dangerous long term consequences.

My advice is to think carefully about which areas of your operation to outsource and focus on outsourcing areas that have a low value to your organisation as well as a low value to any future outsourcer who may, in years to come, decide to become your competition. If, however, you do outsource areas of your operation which they could leverage to compete with you then you must work diligently to determine the long term, downstream implications, build a comprehensive, time sensitive risk register and adopt a multi outsourcer strategy.

________________________________________________________________________________

Click & Connect with Matthew: LinkedIn . @mgriffin_uk . +44 (0) 7957 456194

About the Author: Recognised in 2013 and 2014 by the public as one of Europe’s leading Emerging Technology and Disruption Strategy advisers Matthew Griffin is an international speaker who works with global Accelerators, Analysts, Entrepreneurs, Investors, Governments and Fortune and FTSE multi nationals to help them reinvent themselves and adapt to new market conditions.

________________________________________________________________________________