There is at the moment a lack of sufficient financial resources that is directed toward green investments in order to meet the climate goals that were set in 2015 during the Conference of the Parties to the United Nations Framework Convention on Climate Change (COP-UNFCCC). This lack of sufficient financial resources is also known as the “green finance gap”.

Investment processes, accounting frameworks, and financial regulatory systems have an intrinsic carbon bias and do not favour climate-friendly investments. In the financial sector there is a scientifically proven preference for investments with the following characteristics: short term returns, low risk or low uncertainty and high liquidity.

Climate-friendly investments have however longer payback periods and are therefore less liquid. A higher risk premium is needed.

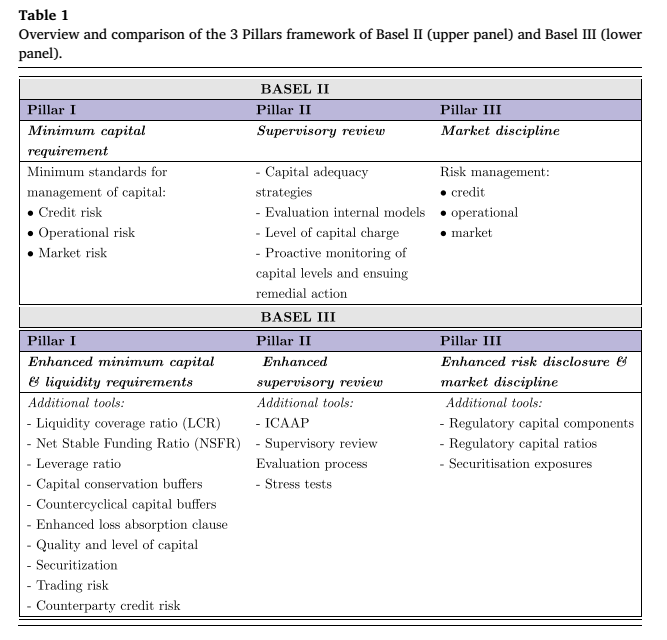

Lessons from the last Global Financial Crisis (2007-2009) were that financial institutions are putting more emphasis on liquidity and risk premiums in order to create a financial stable economy and society. For example banks have strengthened their regulation, supervision and risk management under Basel III (an internationally agreed set of measures developed by the Basel Committee on Banking Supervision) with more emphasis on liquidity. Although these requirements were necessary from a financial perspective, there are no sustainability measures included as D’Orazio & Popoyan (2019) show in table 1.

In order to close the green finance gap more quickly, it is necessary to include more sustainability measures relating to risk, liquidity and calculation methods. Starting point is to make a distinction between three categories of investments:

- “green” investments or climate friendly investments

- “brown” investments or carbon-intensive investments

- “neutral” investments

D’Orazio & Popoyan (2019) propose that Basel III at least should include specific goals for every category relating to capital buffers, minimum and/or maximum weightings, liquidity standards and risk control measures. This can make the economy less dependent of carbon-intensive activities and reduce not only environmental risks but also other risks (oil and gas depency, pollution, long term availability of scarce resources etc.).

Improving Basel III by including sustainabitity measures is necessary to close the green finance gap. However improving Basel III could take some time. To enhance the closing of this green gap, financial markets can already start to formulate, use and disclose information about their investments in the categories “green”, “neutral” and “brown”. It is my opinion that the green finance gap, but also the green gap in behavior, can be closed at more speed when we know what the gap is we need to close.

Literature

D’Orazio, P., & Popoyan, L. (2019). Fostering green investments and tackling climate-related financial risks: which role for macroprudential policies?. Ecological Economics, 160, 25-37.

Photo by harry harris on Foter.com / CC BY-NC-SA