Disruption in health care started to accelerate about 15 years ago when models like One Medical and iora health launched their lower-cost, more affordable, and more accessible approaches to primary and on-demand care. I started to follow these new market entrants closely back in 2013 as their competitive moves had implications for incumbent health care providers. Now, almost a decade later, what started as a handful of low-end and new market disruptors has turned into a mass move up market.

This move is just what the theory of Disruptive Innovation would predict. And the result is that incumbents now find themselves surrounded by potential disruption on all sides. This means new competition is now threatening the entire value chain—disintermediating traditional organizations’ relationships with consumers and threatening their ability to deliver effective care across the continuum.

In this piece, I’ll look at why this is a problem and where it started. In Part 2, we’ll dive into where disruption is today and how incumbents can respond.

What is Disruptive Innovation, and why does it matter?

Opportunities for disruption occur when a smaller company with fewer resources is able to effectively challenge incumbents. They do this by offering lower performance, more affordable, and/or more accessible products and services to the market. Incumbents originally ignore these lower cost and lower performance offerings as they aren’t a fit for incumbents’ best customers. Incumbents instead focus on improving products for their best customers (sustaining innovations). Problems for incumbents occur because disruptors eventually move up market to serve these best customer segments. Then, disruption happens when mainstream customers adopt new entrants’ offerings en masse.

So what can incumbents do? It depends on the type of innovation that enters the market, as sustaining innovations require a different response than potentially disruptive ones. When a new entrant attempts to go after the incumbents’ best customers by offering a sustaining innovation, the incumbent will likely succeed with a counterattack. However, when new entrants offer a disruptive innovation, the incumbent is likely to ignore them at first—to their own peril later—allowing the new entrant the space and time to disrupt the status quo.

In The Innovator’s Solution Clayton Christensen stated, “Competitiveness is far more about doing what customers value than doing what you think you’re good at. Staying competitive requires the ability to learn new things, rather than clinging to the sources of past glory.” This is especially true in health care today. The industry must operate differently, because the sources of past glory will not take incumbents towards future success.

Why disruption is a problem for health care incumbents

As more potential disruptors have entered the health care landscape, they’ve caused an increasing number of issues for incumbent organizations. This is the effect of three market dynamics:

- Disruptors have created new and unfamiliar rules of competition.

- The types of competitors are changing and their numbers are multiplying.

- Incumbents are in a poor financial position to respond effectively.

First, disruptors are rewriting the rules of the game. At a macro level, the rules of business competition are shifting—and this is happening across industries. The old rules of competition were based on providing a functional and reliable product or service. The new rules are about being fast, flexible, and responsive to consumer needs. Many new entrants are able to offer speed, flexibility, and responsiveness to consumers by leveraging asset-light business models. Just as Airbnb was able to effectively compete with incumbent hotels, asset light business models in health care like Dispatch Health are able to deliver urgent care at home and compete with bricks and mortar urgent care centers. Dispatch Health is just one example. 98point6, Teladoc, Parsley Health, Firefly Health, and a slew of others use a similar asset-light approach to provide more affordable and accessible offerings than the asset-intensive incumbents are able to offer.

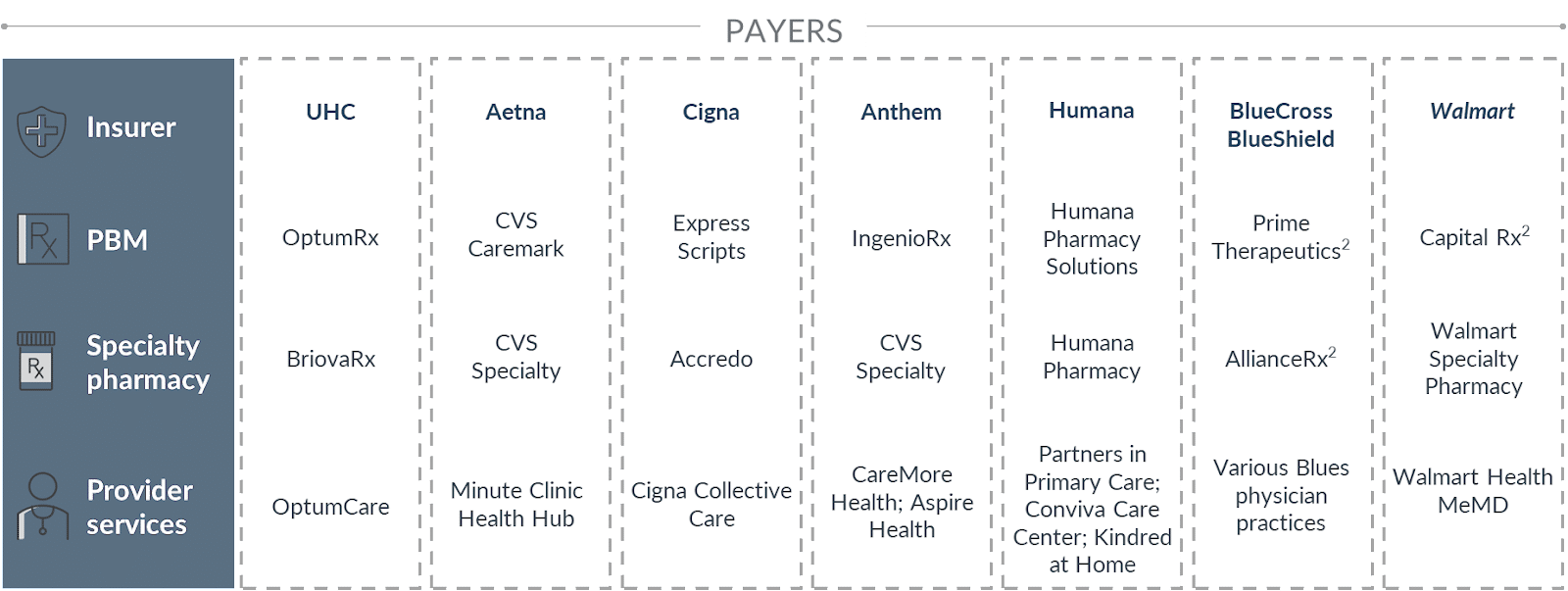

Second, the types of potential disruptors are changing and their numbers are multiplying. What started as a handful of new entrants entering at the low-end of the market (primary and on-demand care) has morphed into a crowded marketplace of startups, startups backed by payers, and startups partnering with providers. As the visual below from The Advisory Board highlights, there are no more pure play “payers” in the US health care market. All major payers are now vertically integrated and offer provider services of some kind. This allows them to encroach on providers’ corner of the market.

Source: Advisory Board 2021; Fein, “Insurers + PBMs + Specialty Pharmacies + Providers: Will Vertical Consolidation Disrupt Drug Channels in 2020?” Drug Channels, December 2020.

Third, in the wake of COVID-19, incumbents are now in a poor place financially to respond to this disruption. While many incumbent providers may have had the cash on hand to implement a rapid strategic response to primary and on-demand care disruption a decade ago—by either building their own disruptive response or buying a potential competitor—that is no longer the case for most today.

Where disruption is going next

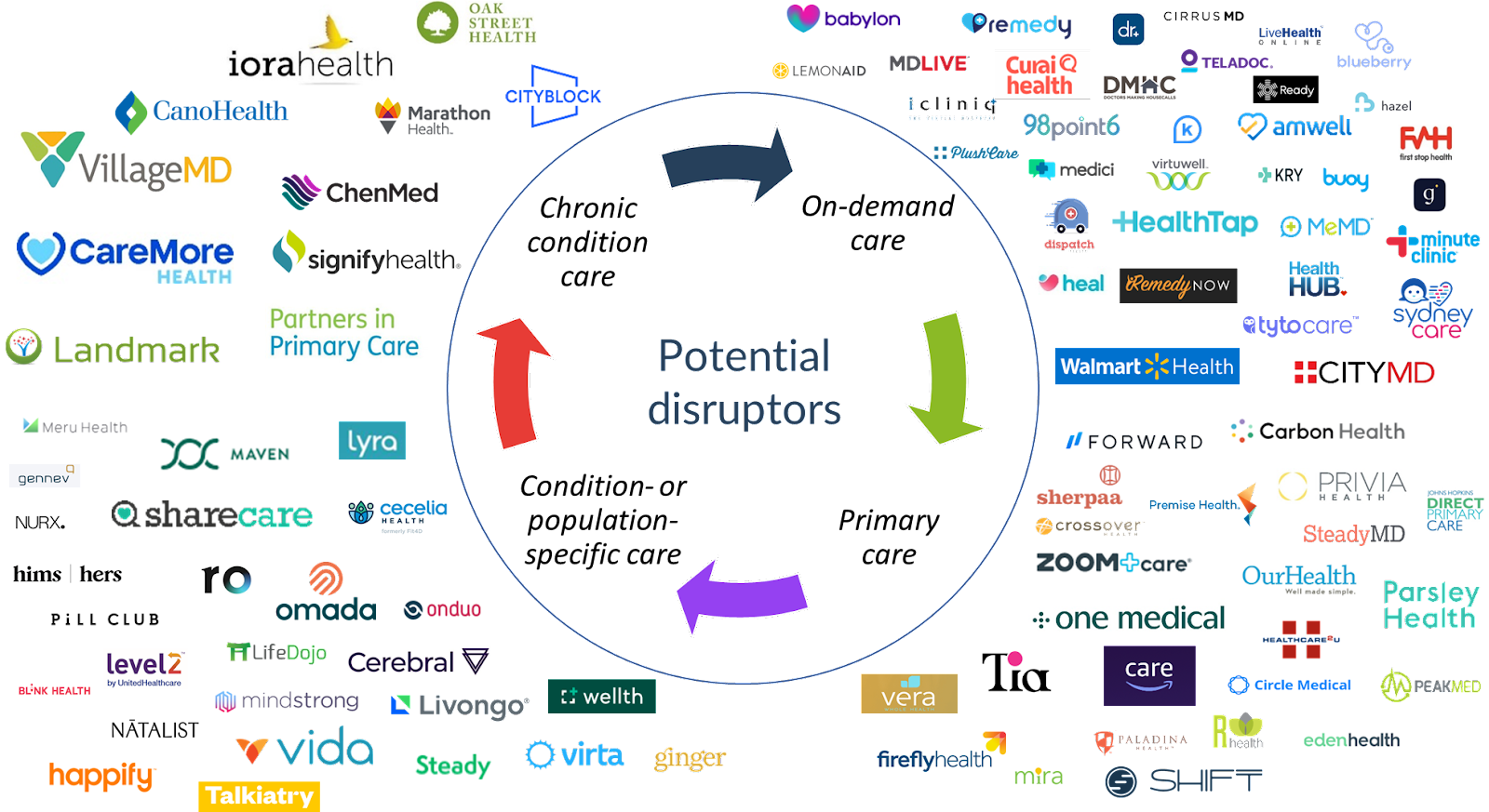

As Disruptive Innovation theory predicts, new entrants don’t stay where they start. Some have moved beyond primary and on-demand care into women’s health, behavioral health, chronic condition management, and higher margin services like cardiovascular and musculoskeletal care. Others have entered the market to target these services directly. The market map below represents a landscape of types of business models that have launched to compete with incumbents. It is not exhaustive of every new entrant, and some models have been acquired or combined with others.

There is no shortage of potential disruptors, and the threat they pose is that they don’t stop at the low-end of the market or once they attract previous non-consumers. They continue to move up market towards higher margin services.

In Part 2, I’ll cover how the market is evolving. That piece will look at specific models competing across the value chain and discuss how incumbents might respond for continued organizational sustainability and improved population health.