Innovation spending grew strongly in Q3

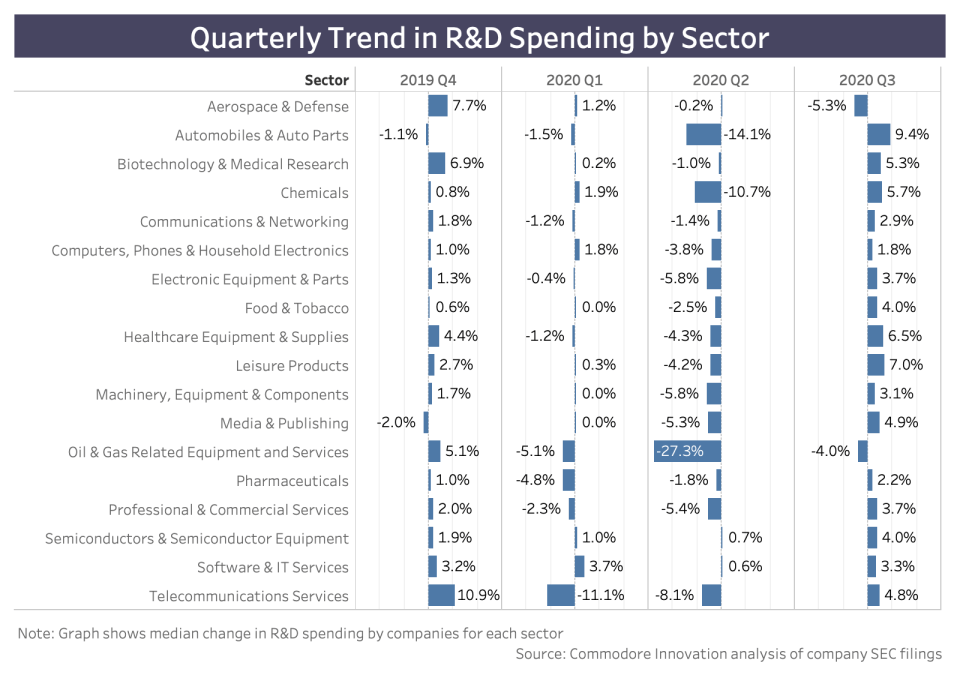

From a sector perspective, the increase in innovation investment was surprisingly broad-based. Only the Aerospace & Defense (5% decline) and Oil & Gas Equipment (4% decline) sectors showed a reduction in investment. These sectors continue to be hit hard by COVID-19 as demand in their customers’ industries (e.g. air travel, oil) show little sign of rebounding in the near future. As a result, companies in these sectors continue to reduce innovation spending as part of broader cash conservation strategies.

Several sectors saw increases in median quarterly innovation investment of over 5%

- Automobiles & Auto Parts

- Leisure Products

- Healthcare Equipment & Supplies

- Chemicals

- Biotechnology & Medical Research

In some cases, these sharp increases represent the (partial) reversal of equally sharp declines in investment earlier in 2020. In other cases, the increased investment is driven by firms who have benefited from changing consumer preferences during the pandemic (e.g. Peloton).

Where next for innovation investment?

1. Innovation is critical to surviving in the new environment created by COVID-19

Most sectors of the economy have been dramatically impacted by COVID-19, for example:

- Customers’ needs are changing—e.g., how can airports innovate to enable physical distancing, avoid congregation at pinch points such as security, and minimize human contact during screening and other processing?

- Channels are disrupted—e.g. book tours used to provide authors (especially first-time authors) with critical exposure (via events at local independent bookstores, local media, etc.). COVID has meant publishers have had to innovate to find new ways of reaching their audience.

For many companies, that means innovation is essential just to survive in their existing, core markets. This may be a different experience to prior recessions, when many firms simply had to wait for demand to rebound, largely unchanged.

Budget-constrained innovation teams may struggle to find capacity to understand and respond to the changing environment. Failure to do so will give competitors or new entrants an opportunity to get ahead. Importantly, they’ll have the opportunity to (a) learn alongside changing customer needs and (b) potentially even shape customer preferences in a way that gives them an advantage.

2. Budget cuts = loss of key people = loss of learning

Budget cuts can result in the loss of key people—either directly (layoffs) or indirectly (as people seek better environments with more secure funding. With the loss of people you lose capacity to execute innovation projects, but more importantly, you lose a wealth of experience and learning. So much of innovation is about learning, and so little of that learning is ever recorded—either at all, or in a format that is accessible and understandable to people not involved in the original work.

As a result, when you lose people, you often lose much of the learning which they undertook. Worse, you risk losing their knowledge and insight to a direct competitor if they’ve continued to invest in innovation.

3. Progress stalls

Budget cuts mean some projects are canceled or put on hold. Often innovation portfolios are adjusted to put a focus on nearer-term initiatives. That’s understandable, but it inevitably means you’re underinvesting in projects that would fuel your future growth. Obviously, those projects can be restarted in, say, a year’s time when budgets rebound—but there will inevitably be friction losses as you restart projects (e.g. as teams get back up to speed), so you’ll have lost more than a year. And, in the meantime, your competitor(s) who didn’t cut budgets will have continued to move forward.

Check Your Competitors’ Behavior

So, before making decisions about innovation budgets, firms need to evaluate how their competitors are likely to react. The (comparatively) good news is that there’s now data to inform that judgment—we can see how firms reacted to the emergence and evolution of COVID-19 this year.

Of course, circumstances will have changed (e.g. competitors’ cash positions may be less favorable; they may have benefited from changing consumer demand patterns, etc.), but understanding how those circumstances are different, alongside evidence of past behavior, provides you with a more rigorous understanding of the range of their likely behavior. And it’s certainly better than flying blind.

To help with this analysis, Commodore Innovation has assembled a dataset of firms’ quarterly innovation spending over the last 12 months. The data is based on information for US-listed firms contained in SEC filings and includes innovation spending (as measured by R&D expenditure) and R&D intensity (ratio of R&D Expense to Revenue). You can access this data visualization (a snapshot of which is provided below) to check your competitors’ behavior (for free) by registering below.

Register to access data on your competitors' innovation spending patterns for 2020

References

1 – https://www.bea.gov/sites/default/files/2020-10/gdp3q20_adv.pdf

2 – According to SEC filings up to 11/30/20, and based on firms who report quarterly R&D expense data (who account for around 80% of total annual R&D expenditure by US-listed firms).

Category: Latest Blog Posts