Unit Economics: How to Calculate CAC & LTV – It Depends

About the Episode

Elijah Eilert speaks to Paul Orlando about his book Growth Units to discover how to best calculate Customer Acquisition Cost and Lifetime Value. Paul tells us how to significantly improve common calculation methods and how to use those to make critical business decisions. Understanding revenue and cost on a per unit basis for Startups/innovation projects is vital but even established businesses have a lot to gain from doing it right.

Get the Book

Topics and Insights

(01:00) Introducing Paul Orlando and his book Growth Units, the foundation of this episode. Paul initially wrote the book as a reaction to the change in teaching environment caused by Covid 19. This insightful and entertaining book was originally designed to assist with the teaching of University of Southern California students.

(06:30) An overview of Unit Economics, Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV).

(09:00) Exploring the value of analysing the unit level like

- price per unit

- cost to serve that unit

- number of times someone stays to buy that unit

over the business level like

- total revenue

- total cost

- …

The aggregate or business level doesn’t help when the product is still being developed, Product/Market-Fit is not yet established, a profitable channel is still to be determined, and so on.

(11:00) Customer Acquisition Cost means how much money it takes a business to bring someone in and turn into a customer such as word of mouth, paid advertising, sales team, and so on. Lifetime Value is a measure of gross profit a business earns from a customer over time. It often takes more time to understand this than it does to understand CAC.

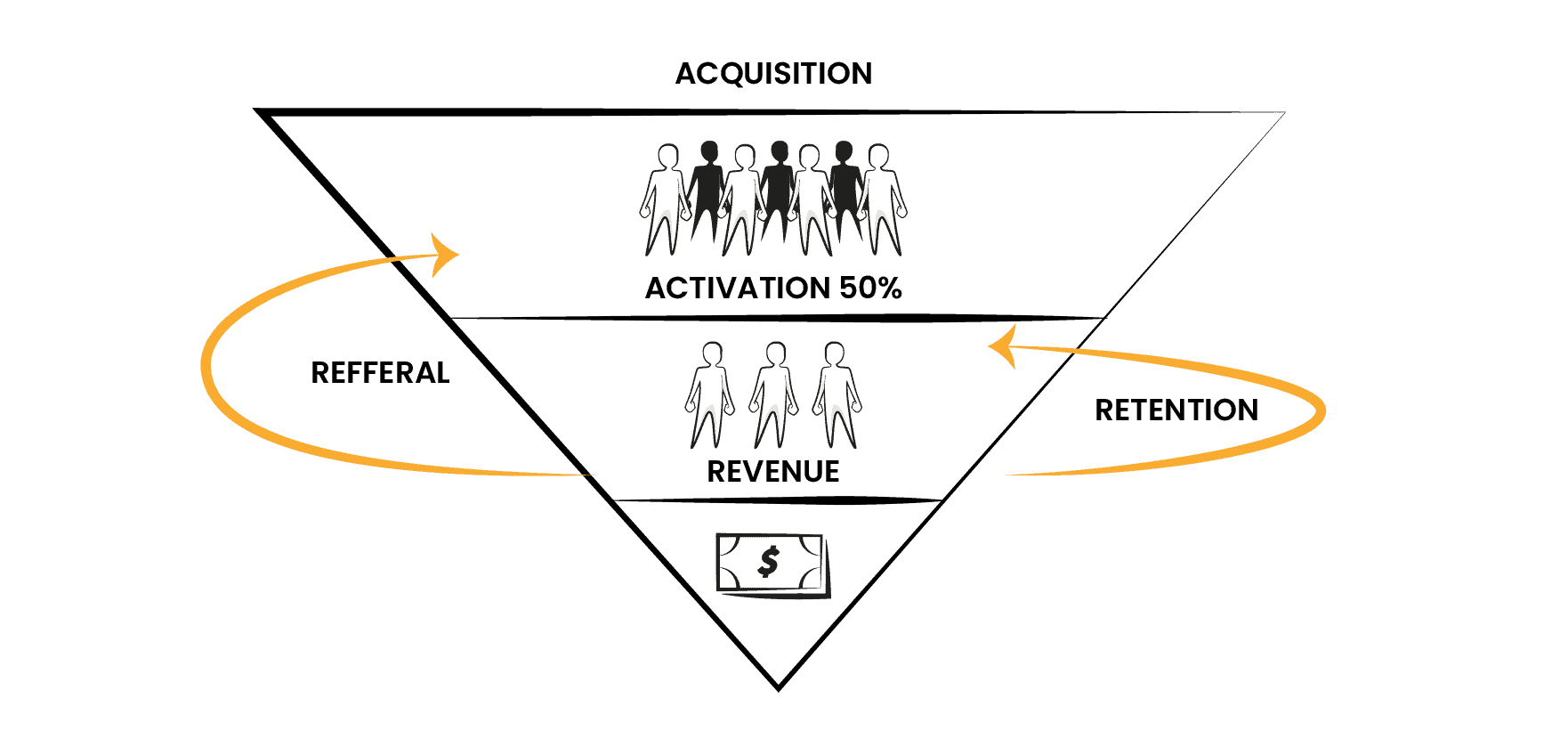

(15:00) CAC over LTV is fundamental to understanding product performance and analysing specific customer segments. It provides a much more forensic look into the performance of the business. This is not just helpful from the product development side, but also for figuring out the best way to grow, what kind of customer should or should not be acquired through paid advertisement, referral or stick around for as long as possible.

(17:30) To properly calculate CAC, one has to look more granularly into the sales funnel. What happens when a customer comes “in the door”, either physically or online, when and how do they become actual customers. There are essentially two parts to this.

(19:00) The different steps in a conversion funnel depend on the type of business and customer behaviours. Pirate Metrics is a great default framework to establish this.

(20:00) The boundary between Acquisition and Activation is not always clear, teams have to ultimately figure it out for themselves, as so often – it depends!

(23:30) How to calculate Customer Acquisition Cost

An Unhelpful way of calculating CAC:

total spent on marketing in period / number of new customers in this period

A reason why this is not helpful, is because it misses the time factor. The marketing dollars spent in a particular period might not be related to the customers onboarded during this same time frame. Another reason is that it does not take customer segmentation into account. It subsequently won’t tell us what segment is particularly lucrative or what segment we don’t want to attract going forward.

A better way of calculating CAC:

cost to get a potential customer “in the door” / becoming a customer

For example, if it costs $10 to get someone “in the door”, and 10% of those people convert, then the CAC will be $100

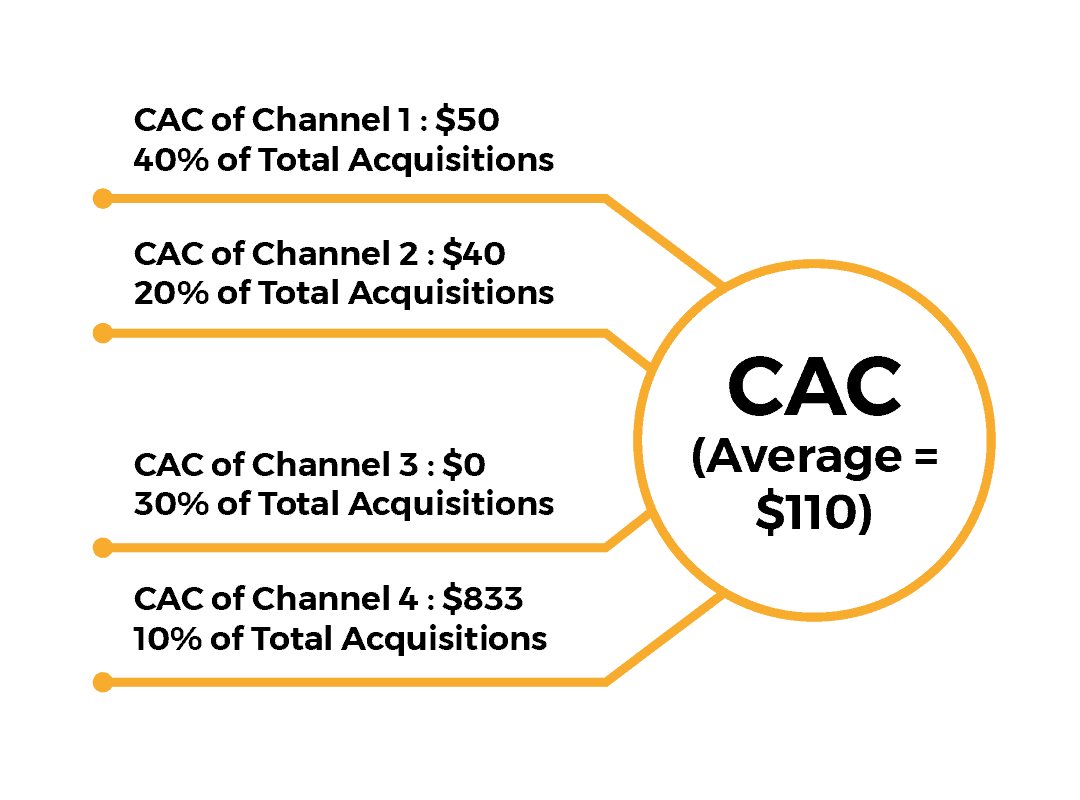

An even better way of calculating CAC:

The cost of getting a customer into the door / conversion rate by cohort

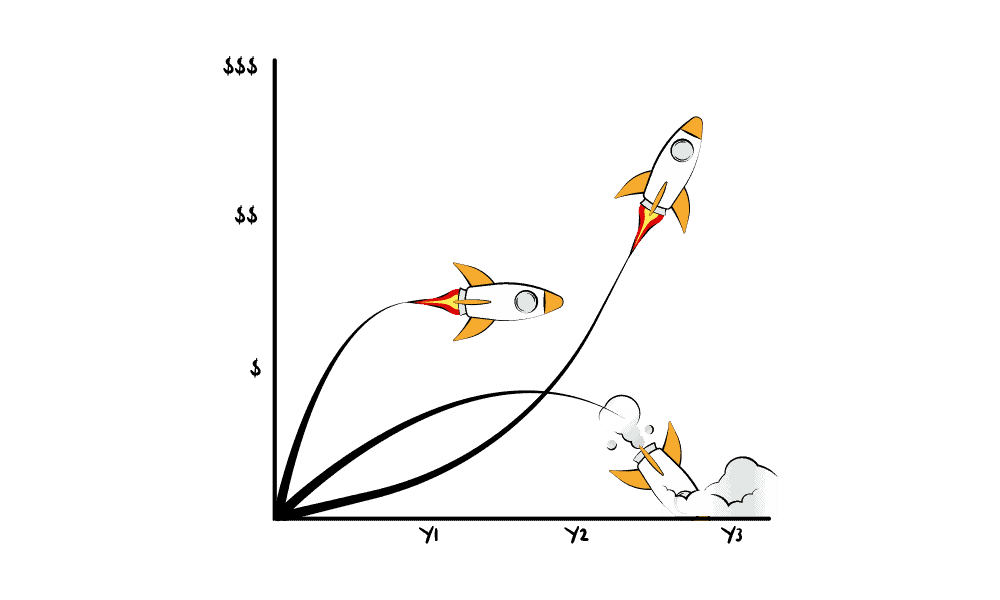

Different channels have different CACs, and it is crucial for a business to understand it to scale/grow.

Graphic adapted from Growth Units, page 18

“As much as possible I stay away from the average. Once you do this, you lose a lot of information.” – Paul Orlando

(27:30) How to pick one initiative over another

(30:00) On how much larger CAC has to be in relation to LTV. 3 or 4 to 1 is common, but this metric on its own can be very deceiving without looking at payback time. Paul gives an example from his book. In this example, CAC/LTV looks great but the payback time for the initial investment is 3 years, making it impossible to grow for this particular business model. So what is the right CAC:LTV ratio? As Paul would say – “It depends”.

(32:00) LTV is like a river, it flows.

(33:00) A bad dad joke from Elijah & a shoutout to Ana for the podcast post-production.

(40:00) How to calculate Lifetime Value. LTV is harder to calculate than CAC, mainly because LTV is calculated over time.

An unhelpful way of calculating LTV:

Most commonly LTV is calculated by revenue, the price of the product.

A better way of calculating LTV:

LTV should be broken down into three parts

Price of the Product – Cost of the Product x Number of repeat purchases

It is important not to hide the parts of the calculation as too much context would be lost. In other words vital information to drive the business. Paul gives a great example of how this drives vital business decisions.

An even better way to calculate LTV:

LTV should be expressed as a time series. As mentioned earlier, LTV is like a river that flows. This means that one needs to account for specific cohorts from a specific channel in a specific month.

(41:00) On Weighted Gross Margins and Negative Churn.

(43:00) A perspective on Product/Market-Fit (PMF). More important than what PMF truly means, is the fact that teams and organisations have an internal definition. Similarly to the term innovation. It is very hard to reach a goal and be effective without a common definition.

Elements of Product/Market-Fit are

- It is possible to grow organically, low or no CAC

- Further growth is possible

- Profitability at a unit basis

- High retention

(47:30) Using the Sean Ellis test to determine some degree of PMF.

(49:30) PMF is the demarcation line for taking the next step in growing a business and trying to scale it.

(50:30) Paul and Elijah went on a long diversion ending up at innovation accounting but somehow found their way back

(51:30) Finishing off with a case study from Paul’s book about Data Storage and how Gmail and Dropbox were able to launch and scale before the unit economics made sense. This is because they were able to accurately predict the drop in costs.

Show Transcript

About the Guest

Paul Orlando has built startup accelerators/incubators around the world (Los Angeles, Rome, Hong Kong, and remote). He is an Adjunct Professor of Entrepreneurship at the University of Southern California and runs USC’s on-campus Incubator for businesses founded by students, alumni and faculty. Paul advises large organizations on internal product innovation, rapid experimentation and growth. He wrote Growth Units, a book on unit economics.

Connect with Paul

RELATED INNOVATION WORKSHOPS & TRAINING