20 Ways to Show Revenue Potential Without Any

.png)

.png)

I’ve had the pleasure of working with almost 100 pre-seed startups through my work at Collective Campus and Metarise over the past six years.

Most of them are focused on two questions.

How can I validate my idea before building it?

How can I raise capital if I don’t have any income?

In both cases, leading indicators can be of great help.

Leading indicators, as opposed to lagging indicators, are pieces of data that suggest future behavior.

In the case of early-stage startups, there are numerous leading indicators that suggest future revenue.

While by no means conclusive, the use of the following indicators can help to give both founders and investors more certainty and confidence in a startup’s value proposition and its potential to make money.

The use of a whitelist, or waitlist, simply pitches your product’s value proposition in very simple terms, and asks visitors to sign up to the waitlist to be the first to know when it goes live.

Buffer famously used this approach to validate appetite for its social media scheduling tool years ago, and the rest, as they say, is history.

The greater the number of people on your waitlist, the greater your confidence in its usefulness, especially if the percentage of people who convert to your list upon visiting your website is high (>10%).

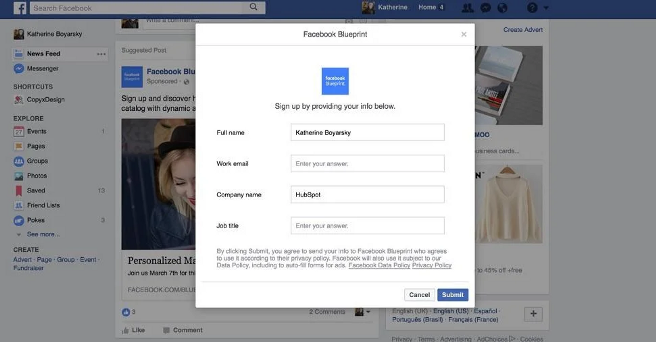

Building off #1, Facebook Ads offer the ability to capture leads on the site, without having to disrupt the user’s experience by navigating them away to your website.

Aside from just the number of people in your mailing list, statistics around open rates and click rates also tell us a bit about how engaged your list is. In 2022, average open rates for most industries is at 21.3% and click rates are at 2.6%.

If your numbers are materially higher than this, that’s a good thing.

If you’re running ads, be it on Google, Facebook, Instagram, or elsewhere, statistics such as click rates, number of impressions, cost per one thousand impressions (CPM), cost per click (CPC), and conversion rates or to a desired end-goal (e.g. cost per lead) all tell us a lot about how much your value proposition resonates with your target audience.

This can help us to start modeling what a prospective cost per user acquisition (CPA) might be, and if it’s considerably less than your projected user lifetime value (LTV), then again, this is a positive indicator, but your sample size of clicks and converts needs to be significant (in the hundreds at least).

If you’re running webinars to introduce your product to prospective enterprise clients, what is ratio of sign-up to invite, attendance to sign-up, and what is the total number of attendees? How engaged were they? Did they stay until the end, and ask questions? All useful indicators.

Again, if you’re in the B2B space and reaching out to prospective clients to introduce your offer or proposed solution, how many meetings have you booked? Do people generally seem interested, or are they just taking the meeting to get out of work?

Are these legitimate prospects with budget, appetite, timing, and need, or underlings who don’t know how to prioritize their time?

Similarly, how many prospective buyers, be they B2B or B2C have given up 30 minutes of their time to view your product demo?

How big is your social media following, and more importantly, how relevant and engaged is it? Anybody can buy bots, but what percentage of your audience are prospective clients or users of your product, and how engaged are they with your posts (what percentage of your audience like, comment, or share your posts?).

To gauge against benchmarks, on Instagram the average engagement rate for all post types is 0.83%, while business accounts with fewer than 10,000 followers have an average engagement rate of 1.11%.

This is especially true for consumer-facing web3 projects that have opted for a bottom-up, user-driven marketing strategy. How big is your community, be it on Twitter, Discord, Telegram, or somewhere else, and how engaged is your community?

While surveys aren’t typically that reliable, because what people say and what people do are two different things, and the quality of people responding to surveys is usually not the best or the most representative of a target audience, it is still a data-point.

How many responses are you getting, and what is the nature of those responses when it comes to validating key assumptions underpinning your product — such as the problem you’re solving, and how much you are looking to charge?

ADVERTISEMENT

ADVERTISEMENT

Just some useful leading indicators when it comes to website stats:

If you publish content, be it simple social media posts, blogs, ebooks, podcasts, videos, or other resources, an indication of content downloads and the size of your platform can be telling.

For example, if your product helps everyday folks launch NFT projects, and your podcast is also about this same topic, then an audience of, say, 20,000 listeners per month is a powerful indicator and platform that you can promote your offering to.

When I got my first book deal with Wiley, the fact that my podcast had hit 1 million all-time downloads was taken into consideration by the publishing house.

While you might struggle to get an enterprise prospect to pay you for a product that doesn’t exist yet, or isn’t fully functional, you could ask them to sign a memorandum of understanding or complete an expression of interest form.

While not legally binding documents, these can both be used to show investors and yourself that buyer appetite is more concrete than a counterfeit “yes” you might get over the phone.

This is more of an external factor, as opposed to an internal one unique to your product. But ultimately, what do Google Trends and similar platforms, say about search terms related to your product?

Is there a lot of upwards momentum?

For example, during the pandemic searches for ‘weight training equipment’ went through the roof on Google Trends, as did sales.

Nowadays, early-stage startups might run a design thinking workshop, or customer discovery workshop, to learn more about their customer pain points, and better design a solution.

In this case it’s useful to know what participation, engagement, and learnings from these sessions have been, and the quality of people who attended.

Nowadays, numerous tools exist that can help you to perform somewhat personalized and targeted cold outreach at scale, such as LeadIQ, LinkedHelper, MixMax, and numerous others.

In this case, you want to know:

If you’re lucky, like I was with Hotdesk back in 2013, you might get some media play with no product and no income. This might be on the novelty and appeal of your proposed idea, and/or how hot the market you’re in is.

While just a vanity metric, demonstrating some media interest is always better than none.

Have you managed to attract some relevant and reputable partners, team members, or advisors?

For example, if I’m building a web3 solution and what I’m proposing is so compelling that the likes of a Brian Armstrong or Vitalik Buterin have agreed to help, then you can bet your bottom line that you’re onto something, and that investors would be interested in learning more.

Of course, we’re talking about the top of the crypto food chain here, but the founder of a modestly successful web3 project in the DeFi space also holds weight for a fledging DeFi project.

If you’ve got a free and lightweight model of your product available, how many people have used it, how long did they use it for, and did they use it again?

Finally, while this article is essentially about how to show revenue potential without revenue, nothing is more powerful than showing that someone, somewhere, has seen enough value in what you’re building that they agreed to take money out of their pocket and put it into your own.

About 80–90% of pre-seed startups I see are pre-revenue, so if you can demonstrate some revenue, you’re already way ahead of the pack.

There is no better validator than this.

.png)

The WorkFlow podcast is hosted by Steve Glaveski with a mission to help you unlock your potential to do more great work in far less time, whether you're working as part of a team or flying solo, and to set you up for a richer life.

To help you avoid stepping into these all too common pitfalls, we’ve reflected on our five years as an organization working on corporate innovation programs across the globe, and have prepared 100 DOs and DON’Ts.

ADVERTISEMENT

ADVERTISEMENT