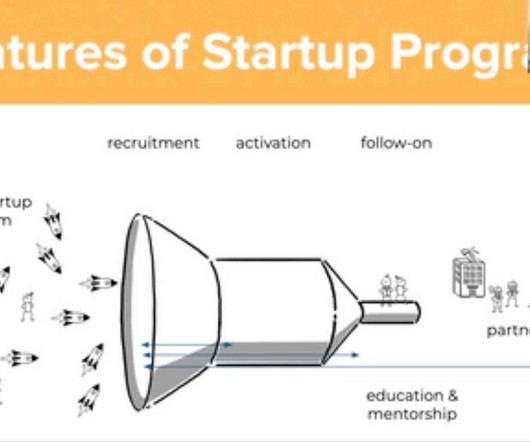

How to run a corporate innovation accelerator?

Board of Innovation

FEBRUARY 14, 2019

Have you been thinking about running a corporate accelerator to boost innovation capabilities at your company? The post How to run a corporate innovation accelerator? appeared first on Board of Innovation. This might help you make your decision.

Let's personalize your content