How “Payment Banks” Could Prevent the Next Bank Collapse

Harvard Business Review

MARCH 17, 2023

Silicon Valley Bank illustrates why payroll shouldn’t be stored in an institution vulnerable to bank runs.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Harvard Business Review

MARCH 17, 2023

Silicon Valley Bank illustrates why payroll shouldn’t be stored in an institution vulnerable to bank runs.

Harvard Business Review

MARCH 24, 2023

It became a fixture among startups because it understood their needs better than other banks.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How Retailers Are Transforming Customer Experiences with Data & AI

Peak Performance: Continuous Testing & Evaluation of LLM-Based Applications

Manufacturing Sustainability Surge: Your Guide to Data-Driven Energy Optimization & Decarbonization

Turn Payments Into Personalization: Unlock the Value of Transaction Data

mjvinnovation

AUGUST 3, 2020

It is impossible to talk about the future of banks without first mentioning the last major transformation in the sector, caused by fintechs. With a natural opening of a new phase in the banking sector, the role of financial agencies in the future of consumption needs to be rethought. Mobile Banking: the future and present of branches.

How Retailers Are Transforming Customer Experiences with Data & AI

Peak Performance: Continuous Testing & Evaluation of LLM-Based Applications

Manufacturing Sustainability Surge: Your Guide to Data-Driven Energy Optimization & Decarbonization

Turn Payments Into Personalization: Unlock the Value of Transaction Data

Harvard Business Review

DECEMBER 18, 2023

Historically, disruption is extremely rare. Only 23 of the 568 companies included in the Fortune 500 since 1997 were under 15 years old when they entered. But right now, there are three forces converging that might transform finance and other industries. The first is the explosive growth of AI.

hackerearth

DECEMBER 26, 2018

Banks have always been custodian of customer data, but they lack the technological and analytical capability to derive value from the data. Whether it is a bank, non-bank, or fintech, competing in the banking revolution comes down to how efficiently the available data can be used to solve business challenges and better serve the customers.

mjvinnovation

SEPTEMBER 22, 2020

These changes in user consumption behavior must always be on your radar, for banks and other financial institutions. In this article, we will explain how Design can provide a differentiated experience for your customers. The same dynamic experience he has with a streaming service is required from a banking institution.

mjvinnovation

SEPTEMBER 11, 2020

a bank that provides delightful experiences combining emotions and finance may seem strange, but we’ll prove that that’s not necessarily true. And not only that: in the meantime, Open Banking has become regulated, which has dramatically affected banks and financial institutions. Nor can banks be.

mjvinnovation

SEPTEMBER 24, 2020

It is no coincidence that the financial market, banks specifically, are among the most innovative. We’ll talk more about that in this article. Keep reading to understand this movement and see what the main benefits of Open Banking are! Why are banks investing in Open Innovation? Open Banking is born.

ITONICS

JANUARY 15, 2018

“Banking is necessary, banks are not”. Many traditional banks have reacted and are now en route to the digital world. ITONICS advises numerous banks on how to make their business models fit for the future and not merely keep up with digitization, but even become a first mover. What about the human factor?

mjvinnovation

APRIL 25, 2019

In this movement, the term Open Banking becomes a promising reality. In this article, we will demystify and simplify the open APIs concept for banks. Keep reading to see what benefits are for banking institutions, their customers and more! The banks’ challenges with Digital Transformation.

Planview

JUNE 15, 2017

Commonwealth Bank , the largest bank in the Southern Hemisphere, is an example of a company that has heavily invested in the creation of a culture of innovation and as a result of their efforts has started to see the fruits of their investment. This is what Commonwealth Bank has tapped into with their CommBank Intrapreneur program.

Planview

JUNE 15, 2017

Commonwealth Bank , the largest bank in the Southern Hemisphere, is an example of a company that has heavily invested in the creation of a culture of innovation and as a result of their efforts has started to see the fruits of their investment. This is what Commonwealth Bank has tapped into with their CommBank Intrapreneur program.

Harvard Business Review

APRIL 28, 2023

SVB was a cautionary tale.

ITONICS

MAY 22, 2019

Trends will matter in the banking industry in the months and years ahead. Or maybe open banking? The post Trends and Technologies Innovating the Banking Industry appeared first on. The challenge is to find out which ones are the most relevant to a given company. Is it big data and AI? Maybe the cloud?

ITONICS

MAY 22, 2019

Trends will matter in the banking industry in the months and years ahead. Or maybe open banking? The post Trends and Technologies Innovating the Banking Industry appeared first on. The challenge is to find out which ones are the most relevant to a given company. Is it big data and AI? Maybe the cloud?

ITONICS

AUGUST 24, 2018

The times when a solid business model worked for decades are also over in the banking sector. The new customer expectations of financial service providers in the digital age pose new challenges for the innovation work in banking. The post How the DZ BANK accelerates Innovation appeared first on.

Harvard Business Review

JULY 31, 2023

A team at McKinsey tracked the performance of 80 banks over four years to identify exactly how their transformation efforts paid off — and how others can follow suit.

ITONICS

AUGUST 16, 2018

The times when a solid business model worked for decades are also over in the banking sector. The new customer expectations of financial service providers in the digital age pose new challenges for the innovation work in banking. The post How the DZ BANK manages Innovation Activities appeared first on.

Harvard Business Review

MARCH 2, 2023

Companies like Shell and DBS Bank are using it to change how their work gets done.

Harvard Business Review

NOVEMBER 16, 2023

banks) and away from suppliers — unsecured creditors who are not viewed as a primary provider of corporate debt. After a company petitions for bankruptcy, its attention often shifts toward debt providers (e.g., New research cautions against such shift in attention.

Harvard Business Review

JUNE 1, 2023

It points toward a continuation of the current tight labor market, even as the economy cools in response to the Federal Reserve’s interest rate hikes and the ongoing banking turmoil. For that reason, many aren’t anticipating layoffs and some are even still hiring.

Tullio Siragusa

OCTOBER 2, 2023

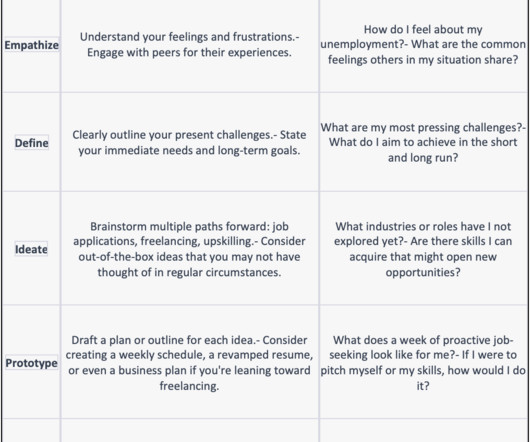

This article sheds light on how to transform this phase into a period of rejuvenation, offering practical strategies to ensure hope, positivity, and evolution. Additionally, banks and other financial institutions might be more flexible than you think. A proactive approach can often lead to renegotiated debts or feasible solutions.

Daniel Burrus

AUGUST 11, 2021

At this point, those who do understand what cryptocurrency is realize the disruptive nature of the concept and how it can upend the banking and financial industry. Just like the Bitcoin boom of late 2017, Dogecoin, Ethereum, and other forms of cryptocurrency are starting to gain constant notoriety in the media.

IdeaScale

AUGUST 23, 2021

In this article, we will outline how important online whiteboards are to the agile methodology and talk about some of the best templates that engage teams using the agile development method. Here are some of the best templates to use with your agile team.

Daniel Burrus

JULY 6, 2022

What Shep aimed his study at was what I have discussed at length in previous blogs and articles regarding the human side of customer service, because, as mentioned above, we are humans buying products, using services, and impacted by business practices.

Harvard Business Review

MAY 23, 2023

Lessons from Kuwait’s Gulf Bank.

mjvinnovation

JULY 24, 2020

We have already touched on the regulation of Open Banking and its pillars. The cycle from Run the Bank to Change of Bank and how important it is to monitor these transitions to stay competitive. Given the information at hand, it’s safe to say that the entire banking sector is diving into an innovation era.

IdeaScale

DECEMBER 10, 2019

Thus, when your company works in a highly regulated industry such as healthcare or banking, you have some extra hoops to jump through. An article in the Harvard Business Review recommends the opposite. Some may see life and all its practicalities as obstacles to innovation, but if truly anything were possible, innovation would be easy.

Innovation Excellence

APRIL 6, 2018

Bank of England’s Chart shows 5,000-year history of interest rates. The chart was published by Business Insider on 17 June 2016 with an article by Elena Holodny entitled “The 5,000-year history of interest rates shows just how historically low US rates are right now”. They are globally at a 5,000 year low! This comment was.

Wazoku

MARCH 3, 2023

The rise in innovation in finance, banking, and the rest of the sector shows that companies are recognizing the need to adapt and grow to forge their way through a downturn. McKinsey research shows that innovating throughout tough periods is necessary in order to accelerate growth in the 5 years after a recession.

Leapfrogging

FEBRUARY 28, 2024

It complements human intelligence in unique ways, allowing for enhanced data analysis, more precise user insights, and the ability to scale design solutions, as discussed in detail in our article on artificial intelligence in design thinking. As AI continues to evolve, so do the tools and techniques used in the design thinking process.

InnovationManagement

JULY 5, 2017

In a recent article, The Financial Brand discussed the biggest threats to the financial and banking industry. They included a long list of everything from profitability to making good hiring decisions. However, we thought that there were a few problems that could be particularly fruitful when applied to open innovation systems.

mjvinnovation

MARCH 8, 2021

Then stay with us until the end of this article! In this article, we are talking more conceptually about APIs. As we said earlier, within this, some concepts from Open Innovation emerge, such as Open Banking – one of the best examples of implementing an open API ecosystem, led by fintechs. What is API?

Planview

FEBRUARY 2, 2016

This article argues that, to stay alive, black cabs need to innovate, not fight against Uber. As Kevin McFarthing mentions in his article examining experience’s affect on innovation, “A lot of people succeed at innovation because they didn’t have enough experience to realize that they should have failed.” Read more →.

mjvinnovation

APRIL 12, 2021

Keep reading the article and understand everything you need to know about B2E! These companies caused an unprecedented movement in the banking sector by elevating the consumer to the role of protagonist in the process of developing new digital products and services. This allows us to return to the example of fintechs and digital banks.

Linda Bernardi

MAY 25, 2022

This article in Financial Times refreshed a question that I have been struggling with for a long time: Why are companies hesitant to use AI? Large companies with massive engineering staff are refusing to use AI, and I think this article points out one of the main reasons. The same holds with banking and insurance services.

Mills-Scofield

MARCH 18, 2019

The current revelation of college admissions scandals and the plethora of recent articles on student’s anxiety and pressure over academic & social success reinforce what so many of us know and see every day. You can and should hold me personally accountable.

Brunner

SEPTEMBER 28, 2023

According to a recent Forbes article “Businesses must uphold the importance of influencer marketing in B2B. She’s worked across a variety of industries, including restaurant, construction, manufacturing, banking, and retail. Kimberly has a B.A. in Integrated Marketing Communications from Duquesne University.

InnovationManagement

MAY 18, 2017

The Bank of England announced last year that they would be looking to boost fintech development, indicating keen interest from financial giants. In this article, we’ll look at a few of the many recent innovative developments in fintech.

IM Insights

OCTOBER 24, 2023

Mention of financial models in sectors like banking and insurance that often require substantial upfront investments in unproven ideas. Transforming two of Canada’s big five banks to a culture of innovation and agility. Emphasis on the necessity of adapting organizational design, including funding models, to foster innovation.

mjvinnovation

AUGUST 16, 2019

Throughout this article, you will deepen this concept and understand why fintechs are a watershed in a sector so consolidated in world capitalism. While cautious, banks are quick to adopt technologies that can create new revenue streams or generate efficiencies. In Brazil and in the world. Follow below!

Stephen Shapiro

JUNE 2, 2020

In the mid-1970s, Citibank was the second largest bank. Banks weren’t open. This article originally appeared on the Inc. .” The ultimate success of the automatic teller machine (ATM) is a great example of this. The story is extremely relevant given our current circumstances. At first, they were not very popular.

mjvinnovation

NOVEMBER 27, 2020

This article brings that reflection. For example, TD Bank recently worked to integrate AI into regular banking, such as mortgage lending and customer support. market to reach $191 billion by 2025. Keep reading to understand the importance of investing in AI , how to get this technology into your business, and more!

Flying Fish Lab

NOVEMBER 23, 2021

Check out other articles on how to set up your ideation sessions for success. Avoid these 5 common mistakes and you should see an instant spike in your idea bank. Keep your ideation sessions on track by only focussing on generating ideas that you can put in your idea bank for consideration at length at another time.

Expert insights. Personalized for you.

Are you sure you want to cancel your subscriptions?

Let's personalize your content