Introducing the Market-Creating Innovation Bootcamp for Policymakers

Christensen Institute

JUNE 15, 2023

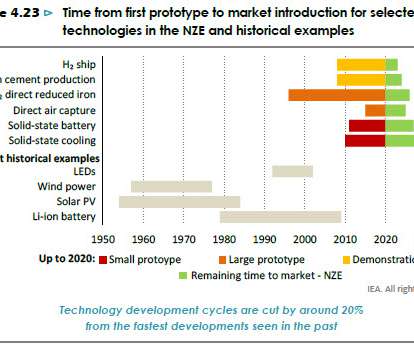

Market-creating innovations transform complicated and expensive products into simple and affordable ones so more people in society can access them. In short, market creating innovations are necessary to create prosperity. However, they can foster an environment that cultivates market creating innovations.

Let's personalize your content