Mastering the Game: Corporate Executives and the Art of Startup Investment

Leapfrogging

FEBRUARY 9, 2024

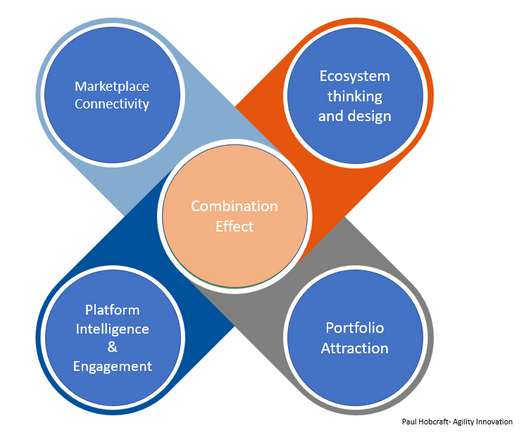

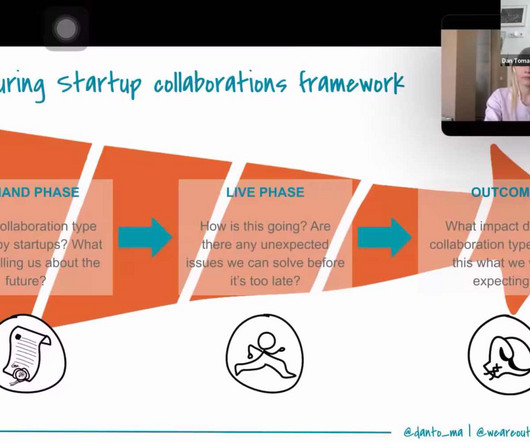

CVC units often focus on securing a competitive advantage by investing in startups with innovative technologies or business models that align with the corporation’s strategic goals. By engaging with and investing in startups, companies can gain insights into emerging technologies, trends, and business practices.

Let's personalize your content